when are property taxes due in madison county illinois

Statement of Economic Interest. Directions to changeupdate scheduled payment information.

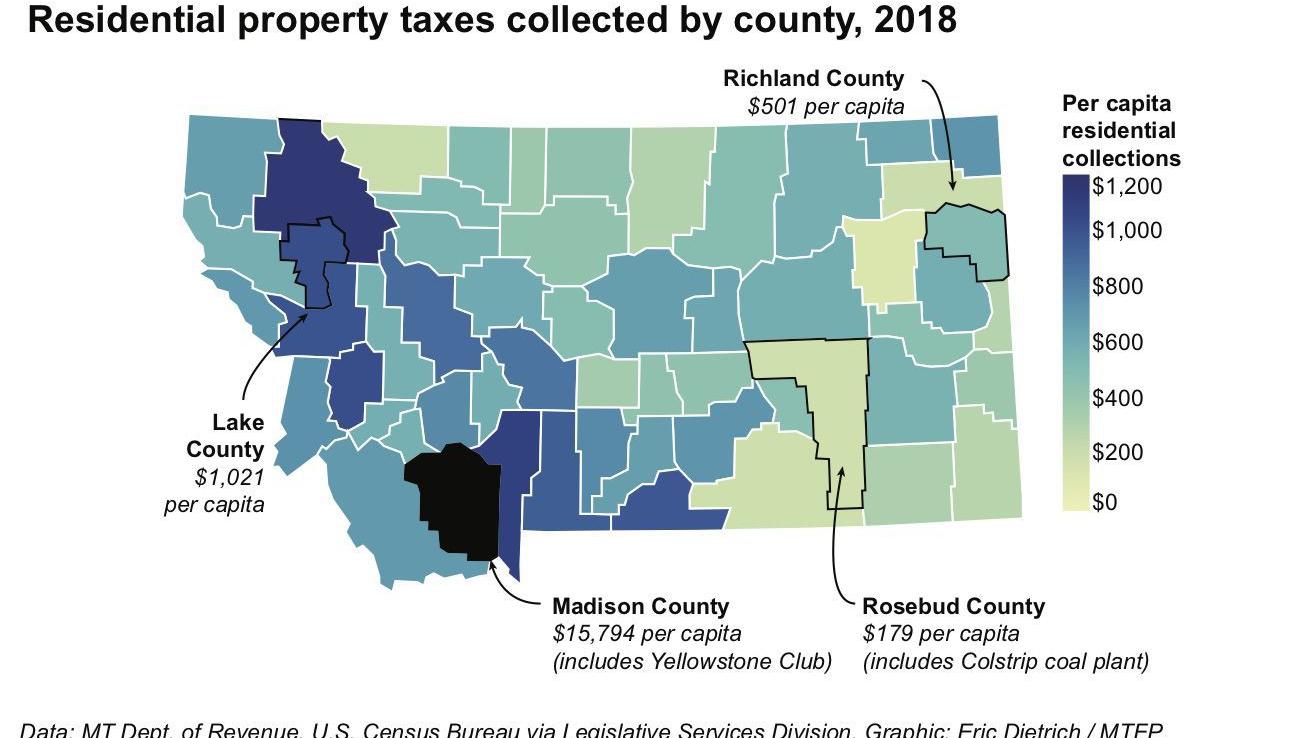

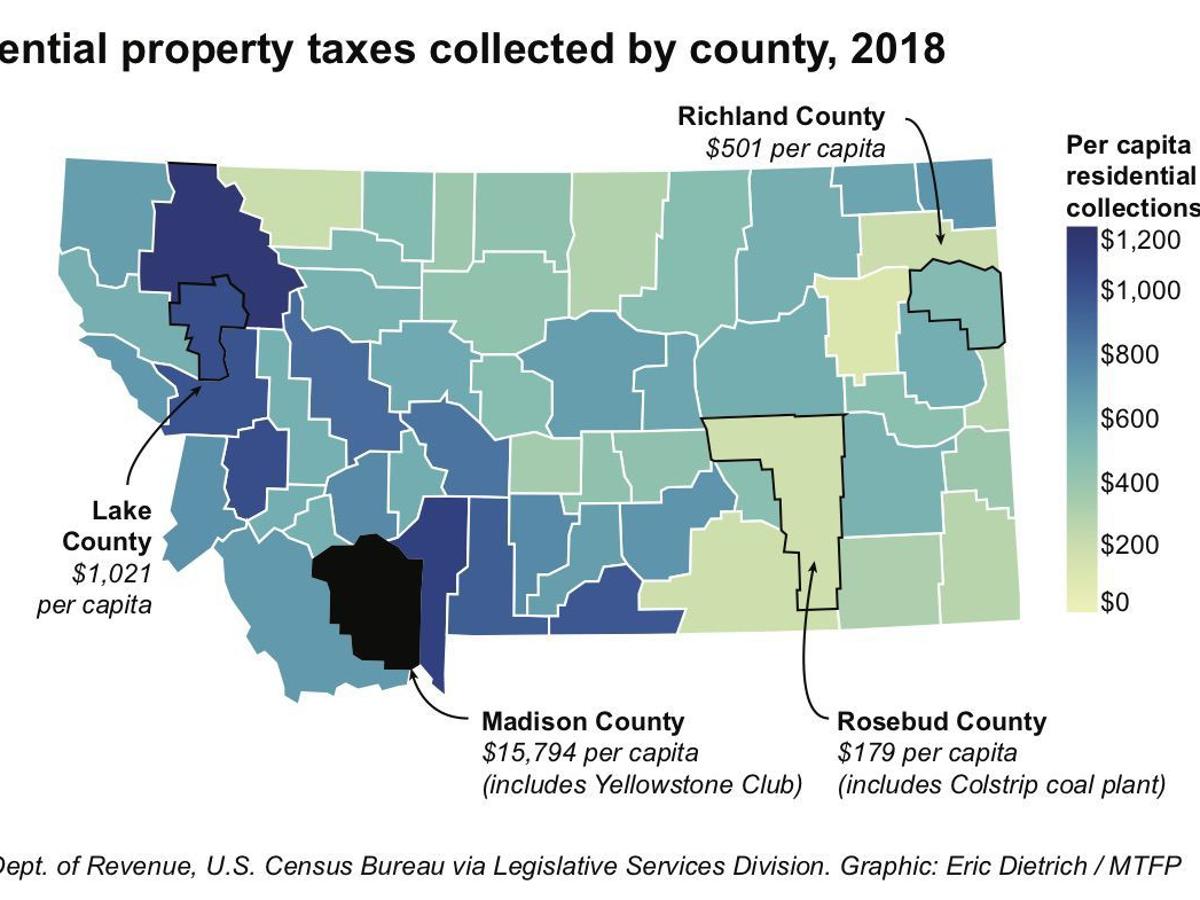

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads News Bozemandailychronicle Com

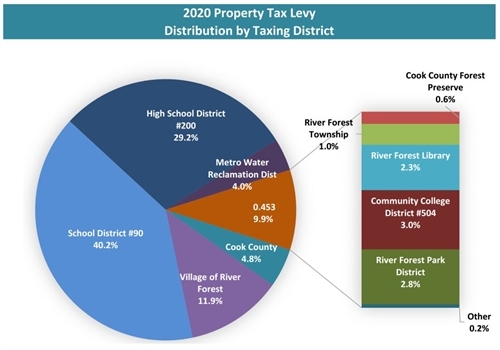

Still property owners generally pay a single consolidated tax levy from the county.

. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Madison County Clerk PO. If you are making payments after January 3rd due to interest and late fees please call our office at 256 532-3370 for an exact tax amount due.

Property tax due dates for 2019 taxes payable in 2020. Madison County Auditor Check Register. Madison County Auditor Financial Reports.

Illinois gives real estate taxation power to thousands of community-based public entities. Pay your Madison County Illinois property tax bills online using this service. The address for the Madison.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. Madison County Property taxes are paid in four installments.

On the due date the. Click here Pay your Madison County property. The median property tax in Madison County Illinois is 2144 per year for a home worth the median value of 122600.

Directions for step-by-step processing for paying taxes online. LAST DAY TO PAY PROPERTY TAXES FOR TY 2020 ON OUR WEBSITE WILL BE FEBRUARY 18 2022 at. Current Tax Year-Taxing District Levy.

Tax amount varies by county. 125 Edwardsville IL 62025. Madison County Treasurer IL 157 North Main Street Ste.

173 of home value. The first half of the tax becomes delinquent on the following May 1 and the second half becomes delinquent on September 1. In most counties property taxes are paid in two installments usually June 1 and September 1.

When are taxes due in Madison County. Monday - Friday E-mail. For comparison the median home value in Madison County is.

Madison County Property Tax Inquiry. To pay your property taxes in Madison County IL you can either mail your payment to the Madison County Treasurers Office or pay in person at the office. Box 218 Edwardsville IL 62025.

Personal property taxes are due December 31. To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site. Madison County collects on average 175 of a propertys.

Welcome to Madison County Illinois.

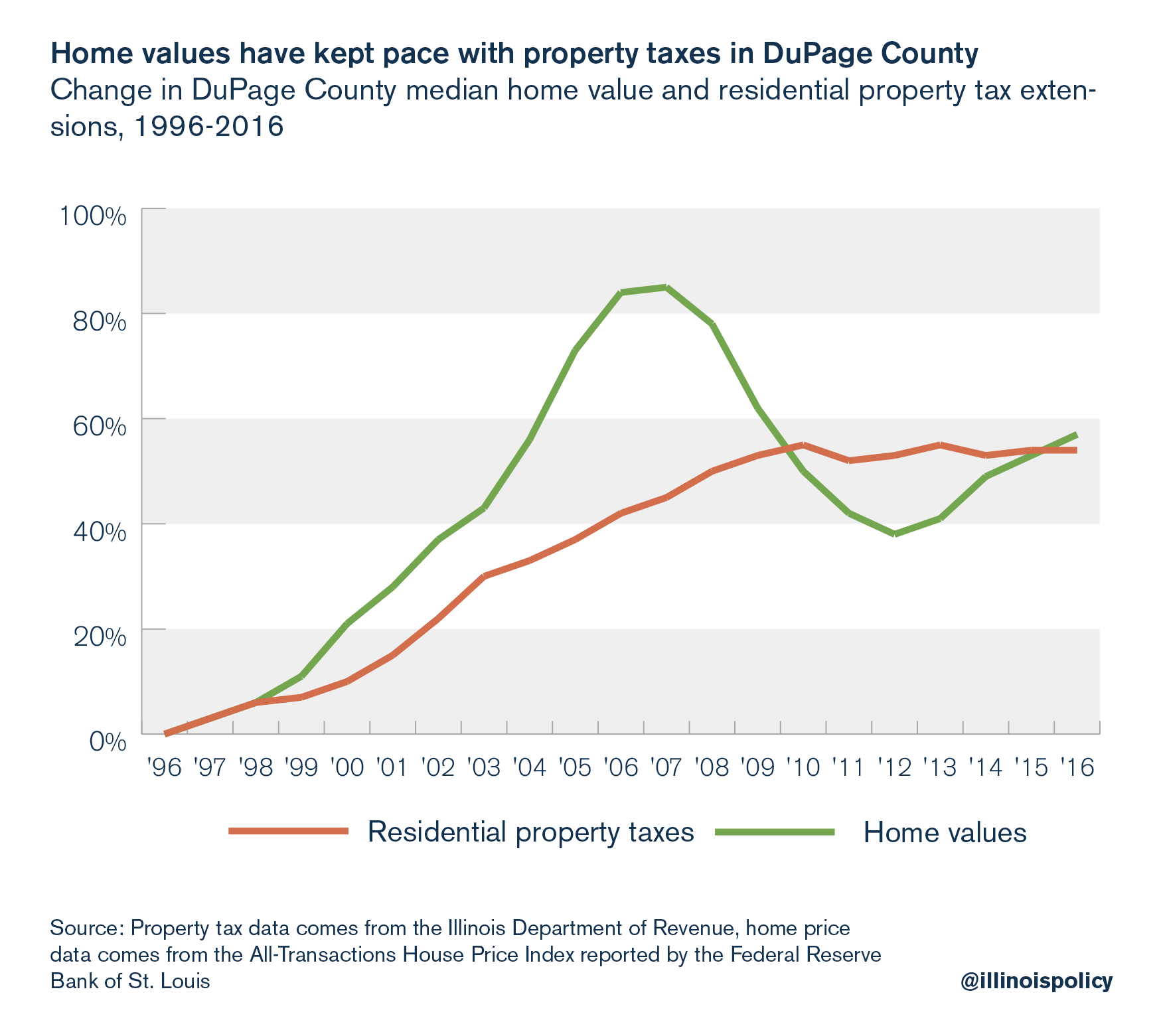

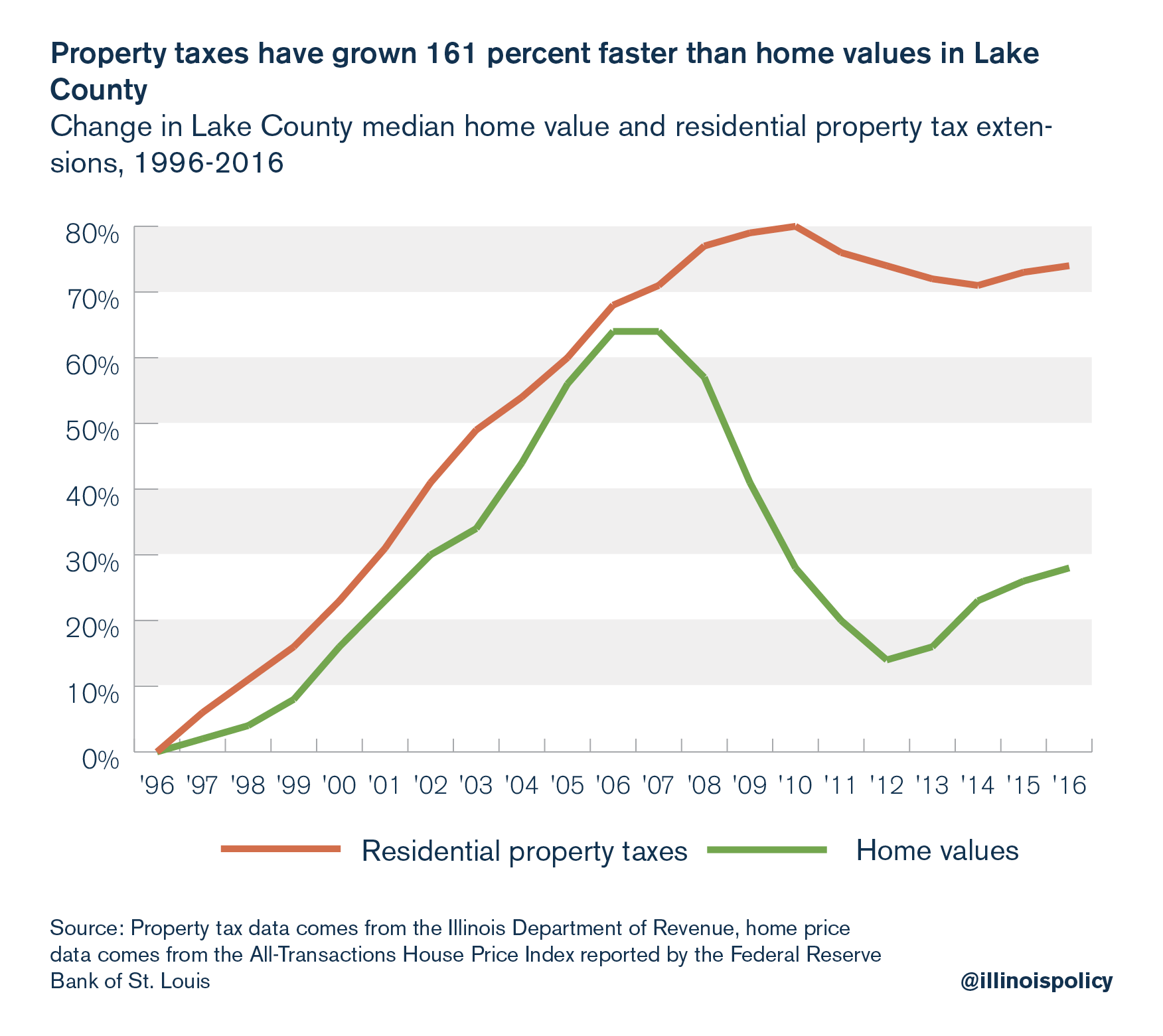

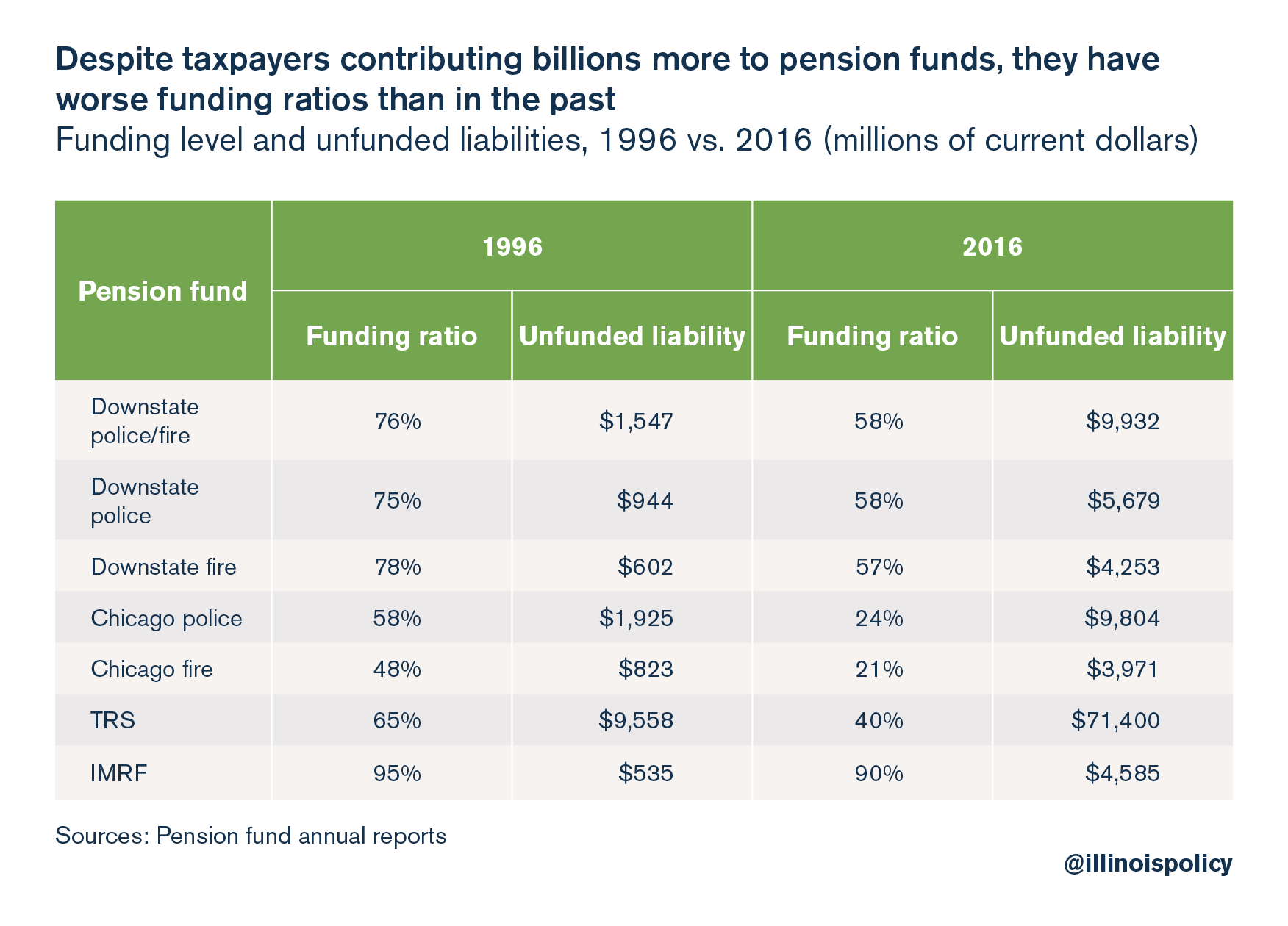

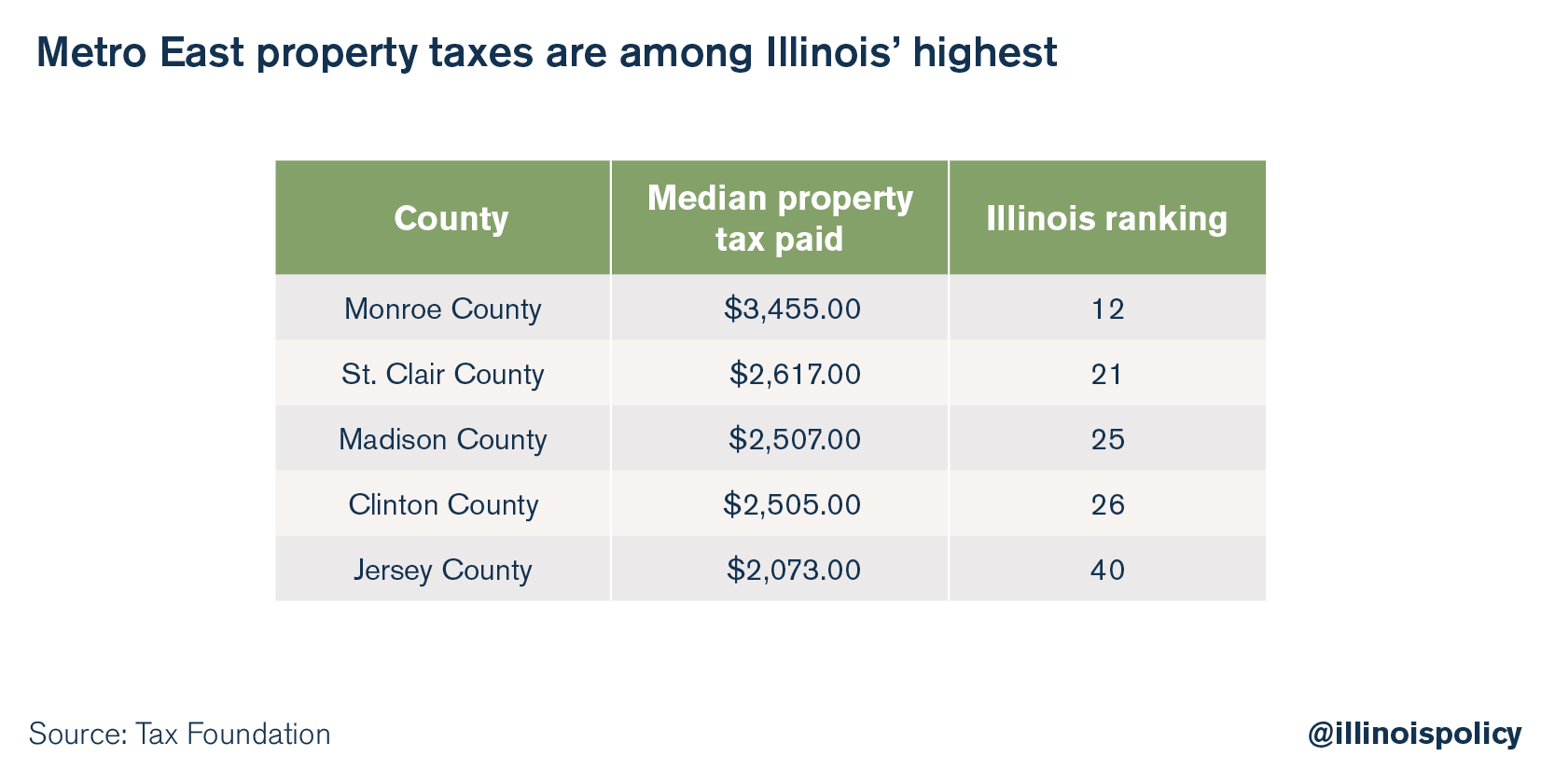

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Illinois Property Tax Calculator Smartasset

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Illinois Used To Have One Competitive Advantage Over Its Neighbors Its Flat Tax Now That S Largely Gone Madison St Clair Record

Madison County Treasurer Facebook

Madison County Treasurer Facebook

Illinois Property Taxes By County 2022

Madison County Il Board Consider Changing Chairman S Job Belleville News Democrat

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads News Bozemandailychronicle Com

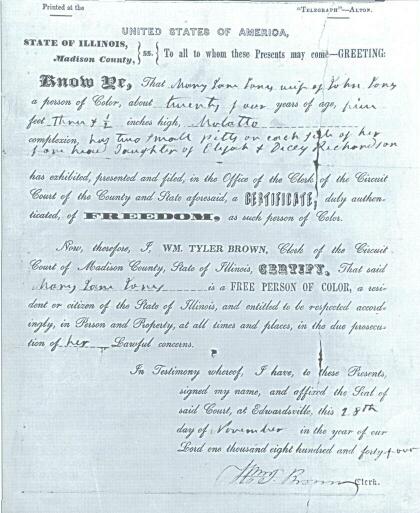

Madison County Kentucky Genealogy Familysearch

Metro East Median Property Taxes Rank In The Top 50 Highest In Illinois

Tax Sale Scheme Cost Madison County Property Owners Millions

Madison County 1812 2012 Reflecting Illinois And National History Madison Historical

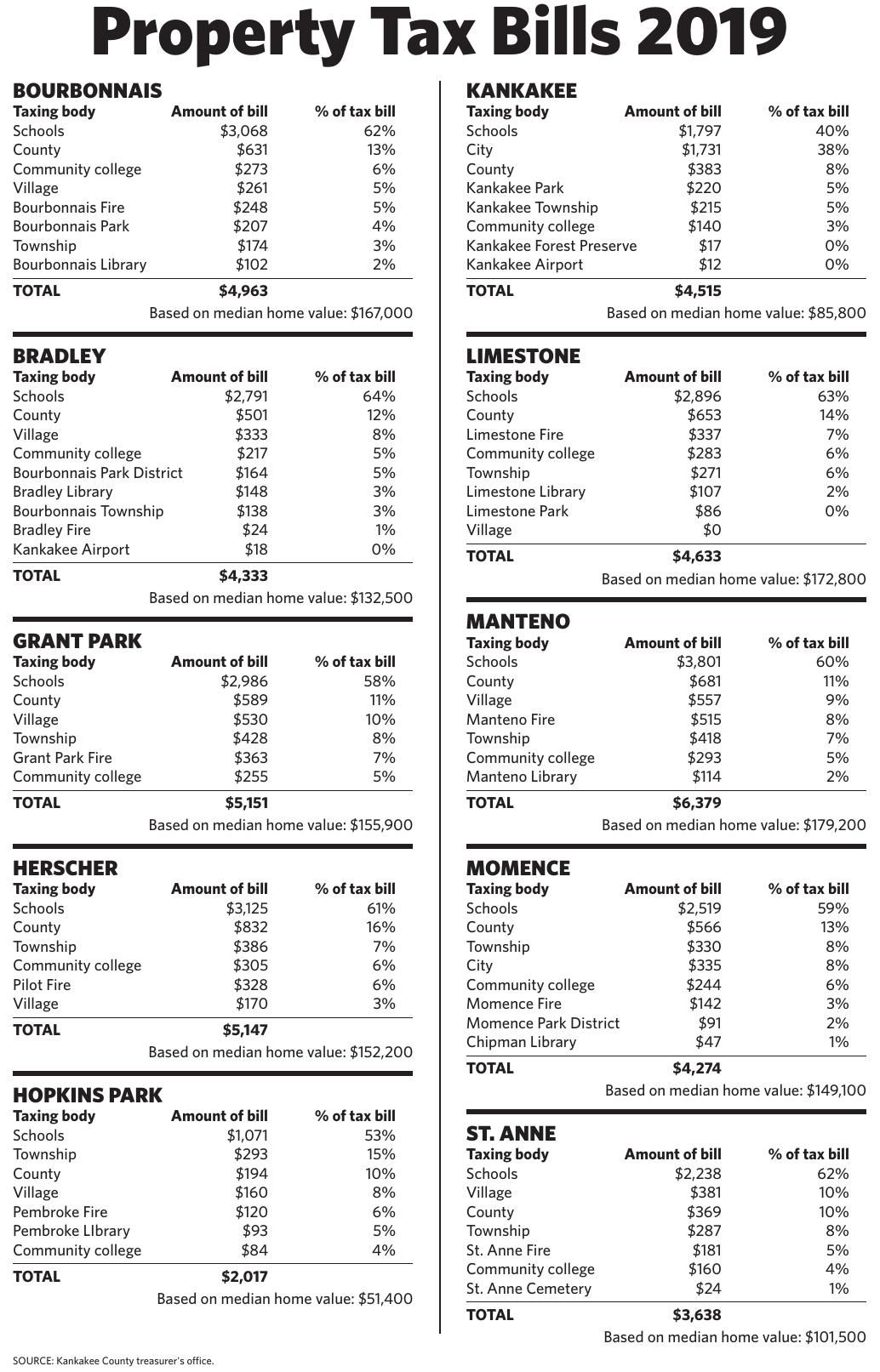

Bigger Tax Burden In Poor Towns Local News Daily Journal Com